Yield

dApp currently under development.

Overview

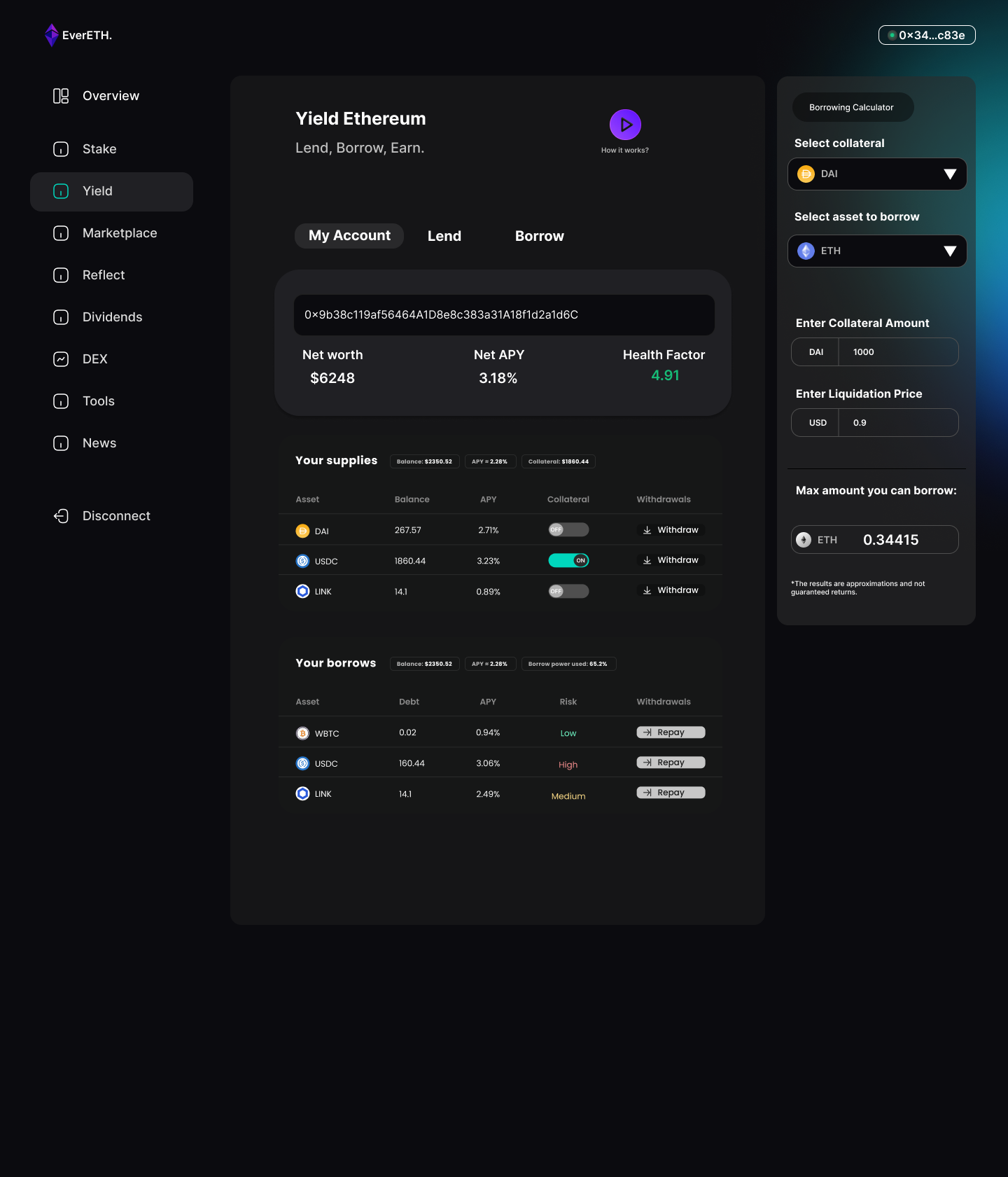

EverETH Yield is a decentralized finance (DeFi) protocol built on the Ethereum blockchain, designed to provide users with a comprehensive platform for lending, borrowing, and yield generation. As a decentralized ecosystem, EverETH Yield empowers users to participate in the new era of financial services, free from traditional intermediaries.

Features

Lending and Borrowing: EverETH Yield allows users to lend their cryptocurrency assets to the platform, earning competitive interest rates. Simultaneously, users can utilize their digital assets as collateral to access instant loans without the need for a central authority.

Dynamic Interest Rates: The protocol dynamically adjusts interest rates based on market conditions, ensuring equilibrium between supply and demand for each supported asset. This feature promotes stability and responsiveness to changing market dynamics.

Insurance Fund:

- Pool funded by redirecting a portion of borrowing fees and liquidation penalties

- Acts as a buffer to cover shortfalls from loans defaulting or having insufficient collateral

- Governed through the EETH token for parameters like fund targets, payouts, etc.

- Prevents losses for lenders and improves sustainability

- Liquidators:

- Independent users who monitor loans and initiate liquidation on undercollateralized positions

- Receive 50% of the 5% liquidation penalty fee as compensation for closing risky loans

- Repay outstanding borrows from at-risk accounts, receive discounted collateral asset in return

- Real-time peer monitoring replaces need for centralized oversight

- Liquidation penalties discourage excessive risk taking by borrowers

Together, the insurance fund and the liquidators significantly reduce counterparty and systemic risks for lenders without centralized oversight. They also outsource loan supervision to an ecosystem of independent liquidators rather than a centralized party. This enhances decentralization and censorship-resistance of the protocol.

Security and Transparency

EverETH Yield prioritizes the security of user funds and the transparency of its operations. The smart contracts will receive rigorous audits by industry-leading security firms, ensuring a secure environment for all participants.

Fees

Here is the fee structure and risk management mechanisms arranged neatly:

Lenders:

- 0% fees

Borrowers:

Borrowing Fees:

- Variable interest rate between 2-5% APR

- 85% goes to liquidity providers

- 10% goes to insurance fund

- 5% goes to EverETH DAO

Origination Fee:

- 0.1% one-time fee on loans

- Goes to EverETH DAO

Liquidation Penalty Fee (if needed):

- 5% fee if undercollateralized

Distribution:

- 2.5% to insurance fund

- 2.5% to liquidator

Insurance Fund:

- Pool covering defaults and shortfalls

- Funded via fees and liquidations

- Governed by token holders

Liquidators/Liquidations:

- Users who monitor loans and collateral ratios

- Initiate liquidation if undercollateralized

- Pay loan+interest+5% fee to seize collateral

- Keep 2.5% as incentive and compensation

Benefits:

- Mitigates risk and defaults for lenders

- Outsources loan supervision

- Incentivizes prudent borrower behavior

- Maintains solvency in decentralized system

The system disincentivizes excessive risk-taking through penalties while incentivizing peer monitoring and governance. This maintains security for lenders without centralized oversight.

Conclusion

EverETH Yield opens the doors to decentralized finance, offering a feature-rich and user-centric platform for lending, borrowing, and yield generation. Empower yourself in the decentralized financial ecosystem with EverETH Yield and participate in shaping the protocol's future through decentralized governance.

EverETH Yield - Risks and Considerations

While EverETH Yield offers exciting opportunities for decentralized finance (DeFi) participation, users should be aware of potential risks associated with interacting with the platform. Here are some important considerations:

1. Market Volatility:

- Risk: Cryptocurrency markets, including Ethereum, are known for their price volatility. The value of assets deposited or borrowed on EverETH Yield can fluctuate significantly.

- Mitigation: Stay informed about market conditions and be cautious of potential price movements. Only invest what you can afford to lose.

2. Smart Contract Risks:

- Risk: EverETH Yield relies on smart contracts. Despite thorough audits, vulnerabilities may exist, posing risks to deposited assets or borrowed funds.

- Mitigation: Monitor community discussions, stay updated on smart contract audits, and be cautious when interacting with decentralized platforms.

3. Impermanent Loss:

- Risk: Liquidity providers may experience impermanent loss due to fluctuations in token prices.

- Mitigation: Understand the concept of impermanent loss, carefully assess the risk, and consider it when providing liquidity.

4. Regulatory Risks:

- Risk: Regulatory changes or uncertainties in the cryptocurrency space may impact the legality and functioning of EverETH Yield.

- Mitigation: Stay informed about regulatory developments and comply with applicable laws and regulations.

5. Economic Model Risks:

- Risk: Changes in tokenomics or economic models may impact rewards, fees, or other aspects of the EverETH Yield protocol.

- Mitigation: Stay updated on project announcements, governance proposals, and potential changes to the platform's economic model.

6. Governance Risks:

- Risk: Decentralized governance relies on active and informed community participation. Unforeseen governance decisions may impact the protocol.

- Mitigation: Participate in community discussions, stay informed about governance proposals, and vote responsibly.

7. Liquidity Risks:

- Risk: Low liquidity in certain pools may impact trading and price accuracy.

- Mitigation: Be aware of liquidity conditions, especially when trading or providing liquidity in less popular pools.

8. External Market Influences:

- Risk: External factors such as global economic conditions, technological changes, or regulatory developments can impact the cryptocurrency market and EverETH Yield.

- Mitigation: Stay informed about broader market trends and consider external influences when making decisions.

Conclusion:

Users should approach EverETH Yield with careful consideration, conduct thorough research, and stay vigilant about potential risks. Diversify your investments, only use funds you can afford to lose, and actively monitor your positions. Remember that the decentralized nature of DeFi platforms implies a personal responsibility for understanding and managing associated risks.

Was this helpful?