Reflect

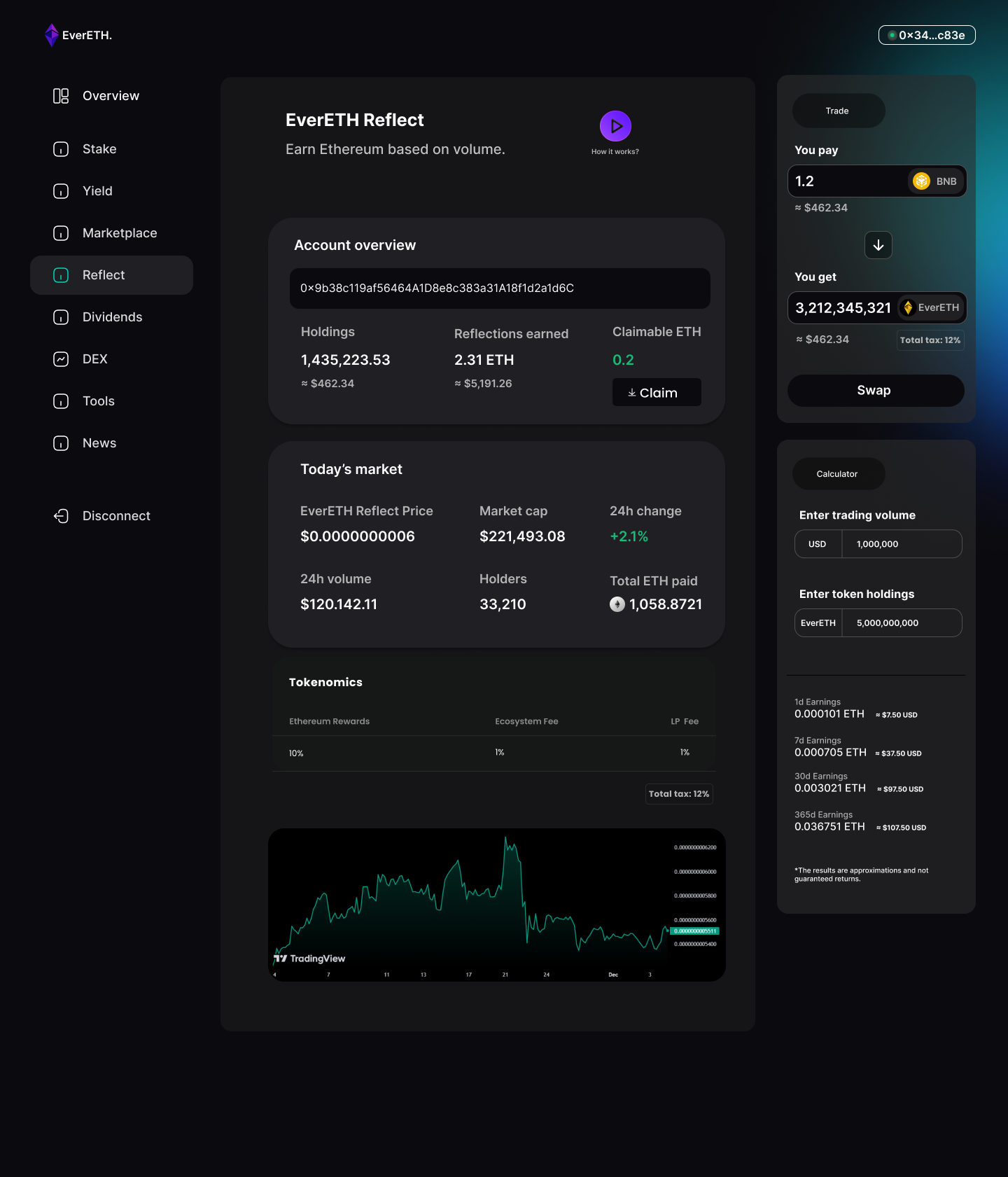

EverETH Reflect is a BEP-20 token that pays holders rewards in ETH. It accomplishes this through a transaction fee reward system.

How It Works

- BEP20 token traded on PancakeSwap

- A percentage of each trade is taken as a fee

- The fee is swapped to ETH

- The ETH is distributed as rewards to EverETH holders

Holder Rewards

One of the most unique aspects of EverETH is how holders are rewarded:

- Rewards are paid automatically in ETH

- No need to stake or claim. Rewards add up in your wallet!

- The more EverETH you hold, the higher percentage of rewards you can receive

- Rewards come from fees on trades, so trading volume directly impacts reward payouts

This innovative system incentivizes holding EverETH for the long-term and provides holders with a passive ETH income stream.

Summary of Benefits

For holders, EverETH offers:

- Rewards paid automatically in ETH

- The more you hold, the higher the rewards

For the project, benefits include:

- Trading volume directly fuels rewards

- Long-term holders are incentivized

Tokenomics

The total tax consists of three components:

Ethereum Rewards Fee: This fee is set to 10% ("EthereumRewardsFee") of the transaction amount. It is distributed as dividends to token holders.

Liquidity Fee: This fee is set to 1% ("liquidityFee") of the transaction amount. It is used to add liquidity to the PancakeSwap exchange.

Ecosystem Development Fee: This fee is set to 1% ("BuyBackFee") of the transaction amount. Funds designated to further develop the EverETH project as a whole mainly used for marketing, sponsorships, personnel and operating costs.

Therefore, the total tax is calculated by adding these three fees together: totalFees = EthereumRewardsFee + liquidityFee + BuyBackFee (Ecosystem Development). The total tax for every transaction made resulting as 12%.

Please note that these values have been changed over the time but now are permanent, and they can not be adjusted by the contract owner anymore (since ownership renounced on Nov-23-2021 09:49:31 PM +UTC).

EverETH Reflect - Risks and Considerations

While EverETH Reflect presents an innovative approach to decentralized finance (DeFi) with its automatic ETH rewards system, it's crucial for users to be aware of potential risks associated with the protocol. Here are some notable risks:

Market Volatility: Cryptocurrency markets, including Ethereum and Binance Smart Chain assets, are known for their price volatility. The value of EverETH Reflect and the ETH rewards can fluctuate significantly, leading to potential financial losses.

Smart Contract Risks: As with any DeFi project, EverETH Reflect relies on smart contracts. While efforts are made to ensure their security, vulnerabilities may still exist. Users should be cautious and consider auditing reports and community sentiment regarding the smart contract's reliability.

Impermanent Loss: Liquidity providers on decentralized exchanges may experience impermanent loss, a temporary reduction in the value of their assets due to market price changes. Users participating in liquidity provision should be aware of this risk.

Regulatory Risks: The regulatory environment for cryptocurrencies and DeFi projects is evolving. Changes in regulations or legal uncertainties could impact the operation and acceptance of EverETH Reflect.

Dependence on Platform Adoption: The success of EverETH Reflect relies on its adoption and community engagement. A lack of interest or changes in user behavior may affect the overall health of the project.

Economic Model Risks: The tokenomics and economic model of EverETH Reflect, including the distribution of fees and rewards, may be subject to adjustment. Users should stay informed about any proposed changes and assess their impact on their holdings.

Smart Contract Upgrade Risks: While updates and improvements to the smart contract are essential, they also pose risks. Users should be cautious when a smart contract upgrade is announced and verify the legitimacy of such announcements.

External Market Influences: External factors, such as global economic conditions, regulatory developments, or technological changes, can impact the entire cryptocurrency market, including EverETH Reflect.

Community and Governance Risks: The decentralized governance model relies on active and informed community participation. Unforeseen governance decisions or lack of community engagement may affect the project's direction.

Liquidity Risks: Users participating in liquidity pools should be aware of potential risks related to low liquidity, which can impact the ease of trading and the accuracy of price discovery.

Users should conduct thorough research, understand the risks involved, and only invest what they can afford to lose. Additionally, staying informed about project updates, security measures, and community discussions is essential for mitigating potential risks associated with EverETH Reflect or any DeFi protocol.

Audits

Certik Audit: https://skynet.certik.com/projects/ever-eth

Techrate Audit: https://github.com/TechRate/Smart-Contract-Audits/blob/main/September/EverETH%20Full%20Smart%20Contract%20Security%20Audit.pdf

Was this helpful?