EverETH

EverETH aims to become a leading innovator and creator of decentralized applications (dApps) and protocols on the Ethereum blockchain.

Products and Services

EverETH plans to launch several signature protocols and dApps that will generate revenue and value for EETH holders and the Ethereum community:

- The very first product “EverETH Reflect” is already live on Binance Smart Chain since 2021.

Under development:

- Liquid Staking Protocol: A liquid staking solution that allows ETH holders to earn staking rewards without locking up their ETH. Users pay a fee to the protocol, which gets distributed to EETH holders.

- Marketplace: A marketplace for buying/selling physical or digital assets. The marketplace charges a premium fee on transactions, which is distributed to the dividend contract.

- DeFi Yield Aggregator: An aggregator that allows users to invest in multiple DeFi protocols from one platform. Aggregator fees are sent to the EETH dividend contract.

- More products and services to be announced.

EETH Token

- ERC-20 token on the Ethereum blockchain

- Used for governance voting, transfers, and access to dividends

- Total supply: 1 billion

- Distribution: https://docs.evereth.net/EETH/Token

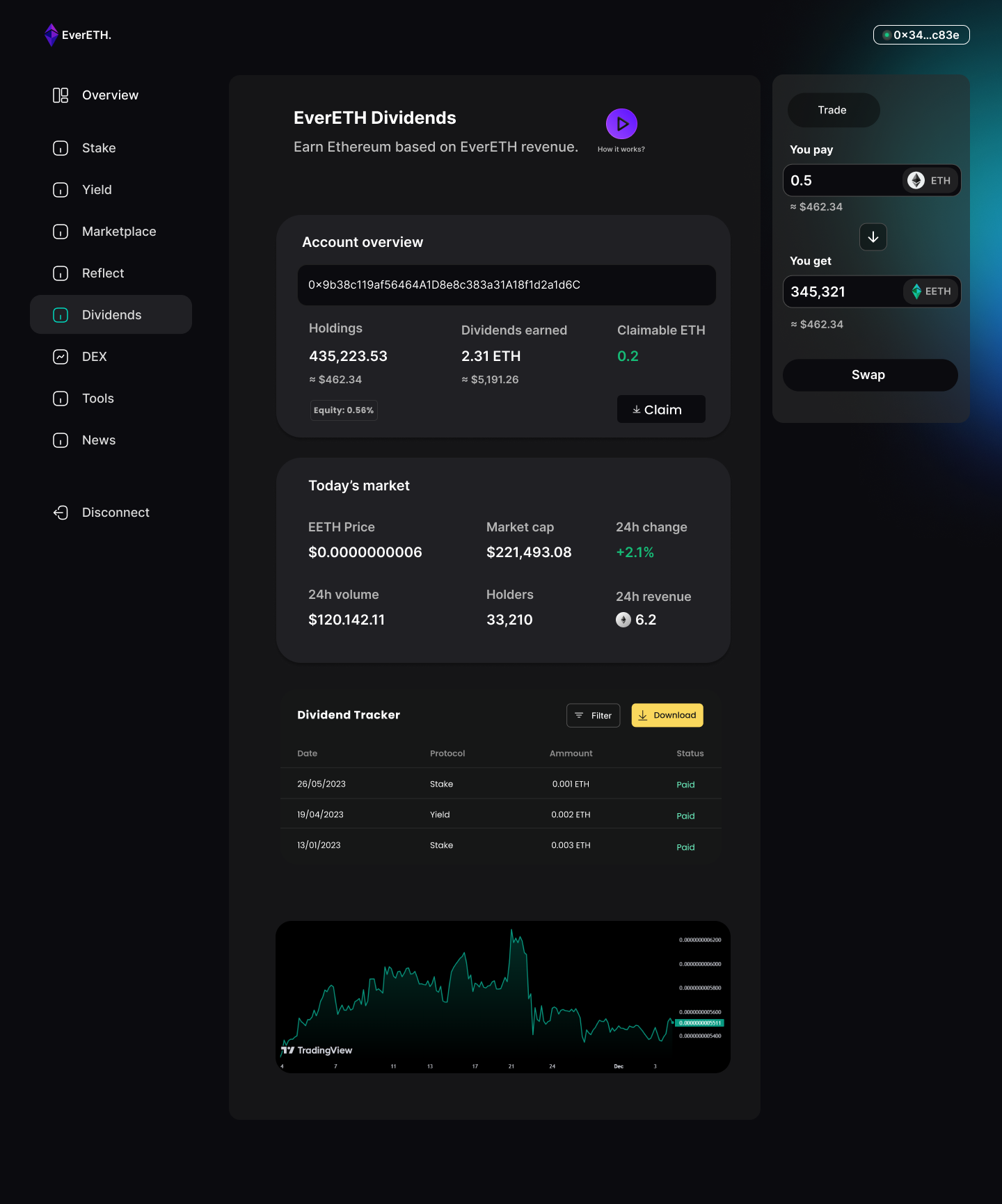

Dividend Mechanism

- An EETH Dividend contract tracks EETH holdings and ETH dividends

- When a user buys EETH, they are minted an equal number of tracking tokens

- Tracking tokens represent a user's share of dividends

- Revenue from EverETH products is accumulated in the Dividend Tracker

- EETH holders can claim ETH dividends proportional to their share of tracking tokens

- Dividend claims are subject to vesting periods to prevent dividend sniping.

Governance

EETH holders can participate in governing the EverETH project and suggest/vote on new proposals. Governance powers include:

- Voting on adding new products or services

- Allocating project funds or revenue

- Changing platform parameters and fees

- Upgrading smart contracts

- Other administrative powers

Was this helpful?