Features

Table of Contents

- Token Basics

- Tokenomics

- Automatic ETH Rewards

- Dividend Tracker

- Liquidity Generation

- Ecosystem Development

- Anti-Whale Mechanism

- Exclusions and Inclusions

- Automated Market Maker (AMM) Integration

- Reflection Mechanism

- Gas Optimization

- Ownership Status

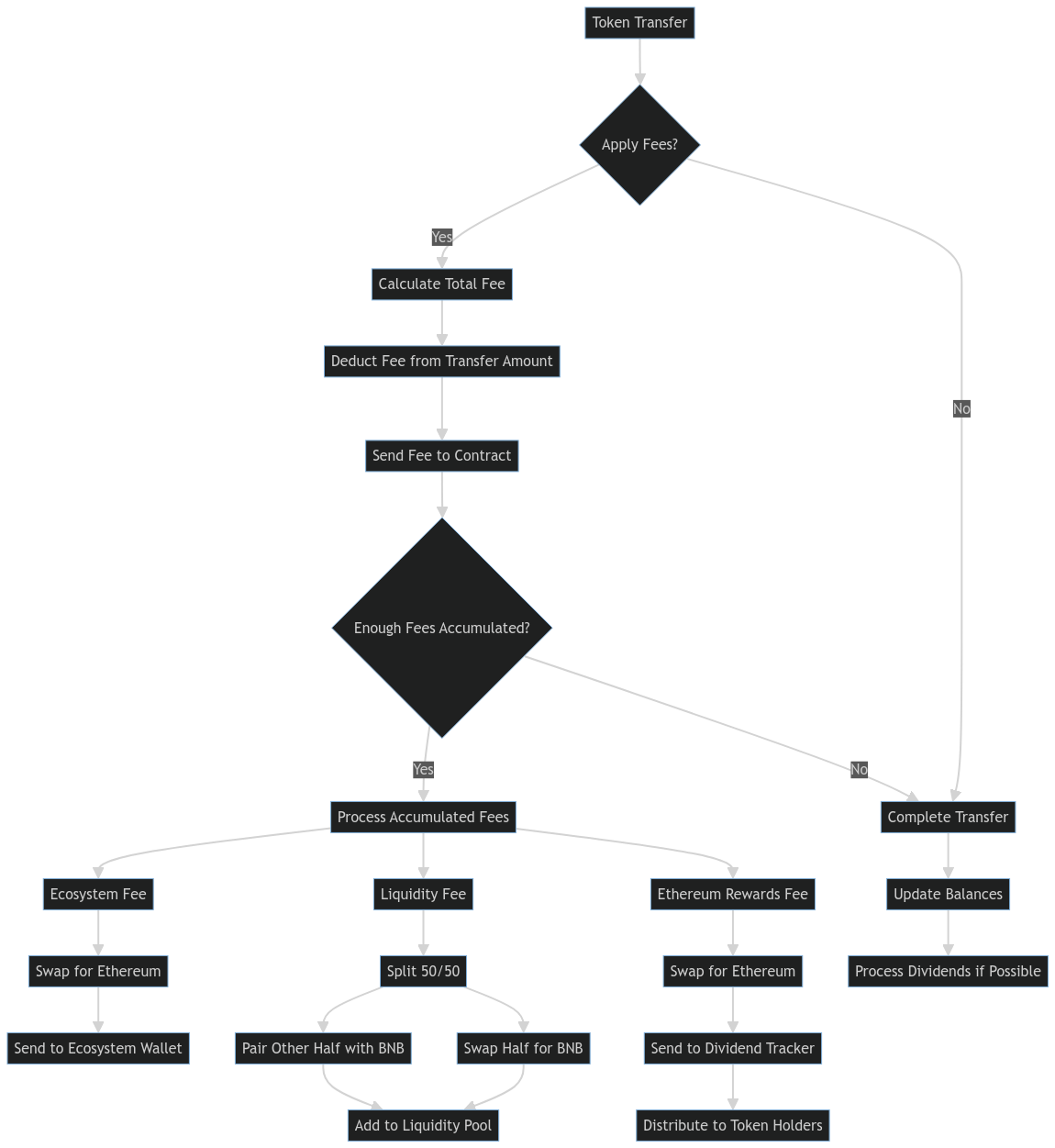

- Tax Mechanism Explained

- Smart Contract Security

1. Token Basics

- Type: BEP-20

- Blockchain: Binance Smart Chain (BSC)

- Trading Platform: PancakeSwap

- Token Name: EverETH

- Token Symbol: EverETH

EverETH Reflect is a BEP-20 token designed to operate on the Binance Smart Chain. It leverages the popularity and efficiency of BSC while providing unique features to benefit its holders.

2. Tokenomics

EverETH Reflect implements a 12% transaction fee, broken down as follows:

- Ethereum Rewards Fee: 10%

- Liquidity Fee: 1%

- Ecosystem Development Fee: 1%

These fees are collected on every transaction and are used to fuel the various features of the protocol.

uint256 public EthereumRewardsFee = 10;

uint256 public liquidityFee = 1;

uint256 public EcosystemFee = 1;

uint256 public totalFees = EthereumRewardsFee.add(liquidityFee).add(EcosystemFee);

3. Automatic ETH Rewards

One of the core features of EverETH Reflect is its ability to automatically distribute ETH rewards to token holders.

How it works:

- The 10% Ethereum Rewards Fee is collected from each transaction.

- This fee is swapped for ETH using PancakeSwap.

- The ETH is then distributed to token holders proportionally to their holdings.

function swapAndSendDividends(uint256 tokens) private {

swapTokensForEthereum(tokens);

uint256 dividends = IERC20(Ethereum).balanceOf(address(this));

bool success = IERC20(Ethereum).transfer(address(dividendTracker), dividends);

if (success) {

dividendTracker.distributeEthereumDividends(dividends);

emit SendDividends(tokens, dividends);

}

}

4. Dividend Tracker

The EverETHDividendTracker contract manages the distribution of ETH rewards to token holders.

Key features:

- Tracks token holder balances

- Calculates and distributes dividends

- Implements a minimum token balance for dividend eligibility

- Allows for exclusion of certain addresses from dividends

contract EverETHDividendTracker is Ownable, DividendPayingToken {

using SafeMath for uint256;

using SafeMathInt for int256;

using IterableMapping for IterableMapping.Map;

IterableMapping.Map private tokenHoldersMap;

uint256 public lastProcessedIndex;

mapping (address => bool) public excludedFromDividends;

mapping (address => uint256) public lastClaimTimes;

uint256 public claimWait;

uint256 public immutable minimumTokenBalanceForDividends;

// ... (other functions and logic)

}

5. Liquidity Generation

To ensure price stability and market depth, 1% of each transaction is used to add liquidity to the EverETH/BNB pair on PancakeSwap.

function swapAndLiquify(uint256 tokens) private {

// split the contract balance into halves

uint256 half = tokens.div(2);

uint256 otherHalf = tokens.sub(half);

// swap tokens for ETH

swapTokensForEth(half);

// add liquidity to uniswap

uint256 newBalance = address(this).balance;

addLiquidity(otherHalf, newBalance);

emit SwapAndLiquify(half, newBalance, otherHalf);

}

6. Ecosystem Development

The 1% Ecosystem Development Fee is collected in a separate wallet to fund various aspects of project growth:

- Marketing initiatives

- Sponsorships

- Personnel costs

- Operating expenses

- Other development needs

This fee ensures the continuous development and promotion of the EverETH Reflect protocol.

7. Anti-Whale Mechanism

To prevent large holders from manipulating the market, EverETH implements a maximum transaction limit. This helps to maintain a fair distribution of tokens and prevents sudden large sell-offs that could negatively impact the token price.

8. Exclusions and Inclusions

The contract owner can exclude or include addresses from fees or dividends. This feature allows for flexibility in managing protocol economics.

function excludeFromFees(address account, bool excluded) public onlyOwner {

require(_isExcludedFromFees[account] != excluded, "EverETH: Account is already the value of 'excluded'");

_isExcludedFromFees[account] = excluded;

emit ExcludeFromFees(account, excluded);

}

9. Automated Market Maker (AMM) Integration

EverETH Reflect integrates with PancakeSwap for liquidity provision and token swaps.

IUniswapV2Router02 public uniswapV2Router;

address public uniswapV2Pair;

constructor() public ERC20("EverETH", "EverETH") {

IUniswapV2Router02 _uniswapV2Router = IUniswapV2Router02(0x10ED43C718714eb63d5aA57B78B54704E256024E);

address _uniswapV2Pair = IUniswapV2Factory(_uniswapV2Router.factory())

.createPair(address(this), _uniswapV2Router.WETH());

uniswapV2Router = _uniswapV2Router;

uniswapV2Pair = _uniswapV2Pair;

}

10. Reflection Mechanism

The reflection mechanism ensures that token holders receive a portion of each transaction proportional to their holdings. This is achieved through the dividend tracker and the automatic distribution of ETH rewards.

11. Gas Optimization

The contract implements gas optimization techniques to ensure efficient processing of rewards and transactions.

uint256 public gasForProcessing = 300000;

function updateGasForProcessing(uint256 newValue) public onlyOwner {

require(newValue >= 200000 && newValue <= 500000, "EverETH: gasForProcessing must be between 200,000 and 500,000");

require(newValue != gasForProcessing, "EverETH: Cannot update gasForProcessing to same value");

emit GasForProcessingUpdated(newValue, gasForProcessing);

gasForProcessing = newValue;

}

12. Ownership Status

It's important to note that the contract ownership was renounced on Nov-23-2021 09:49:31 PM +UTC. This means that the contract parameters, including fee structures, can no longer be adjusted by any central authority, ensuring the decentralization and immutability of the protocol.

13. Tax Mechanism Explained

The EverETH Reflect protocol implements a sophisticated tax mechanism on each token transfer. This mechanism is crucial for generating rewards, maintaining liquidity, and supporting ecosystem development. Here's a detailed breakdown of how it works: